An Unbiased View of Hard Money Georgia

Wiki Article

Everything about Hard Money Georgia

Table of ContentsThe Basic Principles Of Hard Money Georgia 8 Easy Facts About Hard Money Georgia ShownThe 2-Minute Rule for Hard Money GeorgiaA Biased View of Hard Money GeorgiaThe Main Principles Of Hard Money Georgia

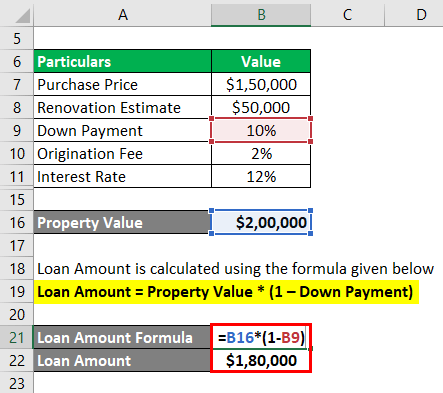

A particular funding barrier is still called for. Hard cash car loans, in some cases described as bridge finances, are short-term lending tools that investor can utilize to finance a financial investment task. This kind of finance is often a device for house flippers or realty designers whose objective is to refurbish or establish a residential or commercial property, after that offer it for a profit. There are two main disadvantages to take into consideration: Tough cash loans are practical, however financiers pay a price for borrowing this method. The rate can be up to 10 percentage points higher than for a conventional loan.

Consequently, these finances include much shorter settlement terms than typical home loan. When selecting a tough cash lending institution, it is very important to have a clear idea of just how quickly the building will certainly come to be rewarding to ensure that you'll be able to settle the financing in a timely way. There are a number of good reasons to take into consideration getting a hard money loan rather of a traditional mortgage from a bank.

Some Known Facts About Hard Money Georgia.

Once more, lenders might permit financiers a little bit of leeway below.Tough cash lendings are an excellent suitable for affluent capitalists who need to obtain financing for a financial investment home promptly, with no of the bureaucracy that accompanies bank financing. When assessing difficult money lending institutions, pay close interest to the charges, rate of interest rates, as well as funding terms. If you wind up paying as well much for a difficult cash loan or cut the settlement period too short, that can affect exactly how lucrative your genuine estate endeavor is in the long term.

If you're wanting to purchase a residence to turn or as a rental residential or commercial property, it can be testing to obtain a typical home mortgage. If your credit rating isn't where a conventional lending institution would certainly like it or you need cash money faster than a loan provider has the ability to offer it, you might be out of luck.

An Unbiased View of Hard Money Georgia

Difficult cash loans are temporary guaranteed financings that use the home you're acquiring as collateral. You won't find one from your financial institution: Hard cash finances are offered by alternative loan providers such as specific investors and exclusive companies, who typically ignore average credit rating and various other financial variables and instead base their choice on the building to be collateralized (hard money georgia).

Hard cash lendings supply a number of benefits for debtors. These include: From start to end up, a difficult money funding may take just a couple of days.

While hard money lendings come with advantages, a borrower should also think about the threats - hard money georgia. Among them are: Hard cash loan providers typically bill a higher rate of interest rate due to the fact that they're assuming even more threat than a standard lending institution would certainly.

The smart Trick of Hard Money Georgia That Nobody is Discussing

You're unsure whether you can afford to settle the hard money funding in a brief amount of time. You have actually got a strong credit history and need to be able to get approved for a standard financing that likely brings a reduced rates of interest. Alternatives to tough money loans consist of typical home mortgages, house equity lendings, friends-and-family finances or financing from the building's vendor.

The 9-Minute Rule for Hard Money Georgia

It is very important to take into account elements such as Full Report the lending institution's credibility and rate of interest. You may ask a trusted realty agent or a fellow home fin for referrals. As soon as you've pin down the right tough cash lender, be prepared to: Think of the deposit, which generally is heftier than the deposit for a standard home mortgage Gather the essential documentation, such as proof of earnings Possibly hire a lawyer to discuss the terms of the car loan after you have actually been accepted Map out a technique for view repaying the finance Equally as with any kind of loan, examine the benefits and drawbacks of a tough cash funding before you commit to borrowing.No matter what kind of loan you select, it's possibly a good suggestion to examine your free credit history and also cost-free credit score report with Experian to see where your funds stand.

When you listen to the words "tough money car loan" (or "private money financing") what's the very first point that goes through your mind? Shady-looking lending institutions that perform their service in dark streets and charge sky-high rate of interest? In previous years, some negative apples stained the tough cash lending industry when a few predacious loan providers were attempting to "loan-to-own", giving extremely dangerous financings to borrowers making use of realty as collateral and intending to foreclose on the properties.

Report this wiki page